[ad_1]

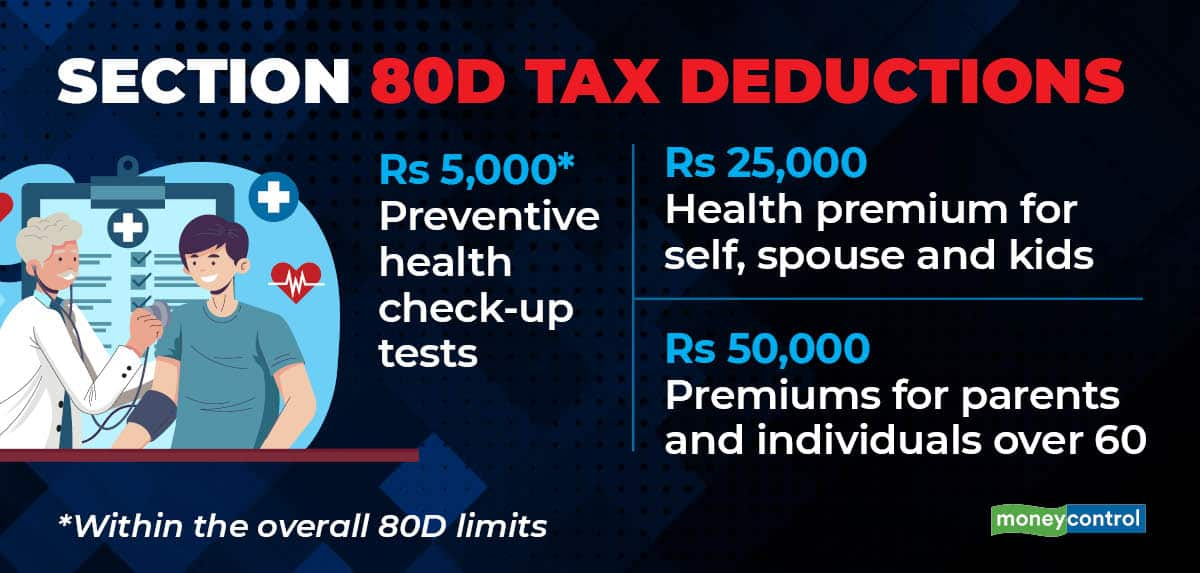

For people below 60 years of age, section 80D of the Income Tax Act, 1961 offers a tax deduction of up to Rs 25,000 on health insurance premium paid for self, spouse and children. If you are a senior citizen or paying premium to your old age health insurance policy, you can claim additional tax up to Rs 50,000. In addition, you and your family are also eligible for a deduction of up to Rs 5,000 for preventive health check-ups under the same section. For example, diagnostic tests to check blood sugar or cholesterol levels. However, the amount of your premiums and preventive health care bills cannot exceed the maximum limit under section 80D.

[ad_2]

Source link