[ad_1]

Having fallen by more than half since November 2020, the Persimmon (LSE:PSN) share price is the worst performer in my Stocks and Shares ISA.

I first bought the FTSE 100 housebuilder just before the pandemic and was primarily attracted by the stockâs generous dividend. At the time, it was paying 235p a share. Nowadays, things are very different.

After a slowdown in the housing market and a period of sustained post-Covid supply-chain inflation, Persimmonâs earnings in 2024 were around half their five-year average. As a result, the groupâs had to cut its dividend by 75%. This is a valuable reminder that payouts cannot be guaranteed.

However, this disciplined approach to returning cash to shareholders has helped ensure that its balance sheet remains healthy. At 30 June, the group had no debt, which is unusual for one of the UK’s largest listed businesses.

‘Expert’ opinion

Encouragingly, a look at the latest forecast of analysts suggests that I could recover some of my losses over the next 12 months. Thatâs because the consensus is for a 24% capital gain. This is based on an average price target of 1,500p.

Okay, even if this proves to be correct, itâs a long way shy of its pre-pandemic level. But thatâs my problem — it could be a different story for those wanting to take a stake now. If the brokers are right, when combined with the groupâs current dividend of 60p, the total return could be as high as 29%. And Iâm sure most investors would be happy with that.

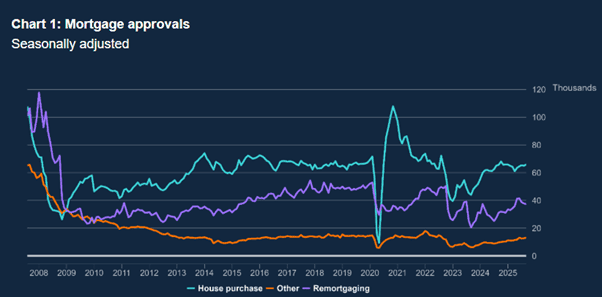

However, the UK housing market is cyclical and while it appears to have turned the corner — mortgage approvals are slowly increasing — a recovery is far from certain.

All eyes on the Budget

And in my opinion, the Autumn Budget at the end of November is critical in determining the direction of Persimmonâs share price over the next year or so. Depending on the Chancellorâs choices — and how her speech is received by bond investors â the housing market could go one of two ways.

If Rachel Reeves breaks her own fiscal rules, gilt rates could surge. Mortgages would then become more expensive and demand for new houses would fall. But even if the markets welcome her prudence, thereâs a risk that the anticipated tax increases could damage consumer confidence and squeeze incomes further. All housebuilders would then suffer. Â

Alternatively, raising the stamp duty threshold — or introducing other incentives for first-time buyers — could help a new generation of buyers get on the housing ladder. In these circumstances, Persimmon could be one of the beneficiaries. The reason being its properties tend to be priced at the cheaper end of the market.

However, irrespective of what happens on 26 November, thereâs still going to be a housing shortage in the country. The government wants to address this by streamlining the planning process. And it sees housebuilding as a key element of its economic growth strategy.

On this basis, Persimmon could be a stock for patient investors to consider. But even if the housing market recovery stalls, thereâs always the groupâs dividend to be thankful for. And savvy investors know that using this income stream to buy more of the groupâs shares at their current historically low level could be a winning long-term strategy.

The post Prediction: analysts reckon the Persimmon share price will jump 24% in a year! Could it? appeared first on The Motley Fool UK.

Should you invest £1,000 in Persimmon Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets.

And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Persimmon Plc made the list?

.custom-cta-button p

margin-bottom: 0 !important;

color:#cc0000;

div.entry-footer div.textwidget div.braze-content-card div.wp-block-custom-block-collection-presentational-card

padding: 0 !important;

margin: 0 !important;

More reading

- As the FTSE 100 index nears another record high, who might the winners and losers be from next month’s budget?

- How big does an ISA need to be to target £1,500 in monthly second income?

- Will Barratt Redrow, Taylor Wimpey, and Persimmon shares be blown away in the Budget?

- Is an Autumn Budget crisis coming for these FTSE 100 stocks?

- 2 FTSE 100 stocks down 19% and 61% to consider in NovemberÂ

James Beard has positions in Persimmon Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

[ad_2]

Source link