This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the infantry before transferring to the Finance Corps.

2022 started with a bang, especially in Canada. Whether you agree or not with the premise behind the Canadian Trucker Protest, I can most agree that freedom of speech is the right keystone in modern Western Democracy.

But when the Canadian government began cracking down on protesters by freezing their bank accounts, people turned to Bitcoin to help them survive. Organizations like GoFundMe not only prevent protesters from receiving the money they raise, but also try to send the money to the same cause. After some uproar, GoFundMe eventually returned the money, but the message was clear: obey.

However, Bitcoin allows truck drivers to overcome these restrictions.

Above is an excerpt from an article from the Motley Fool, written in March 2022. Although I don’t agree with the conclusion or the reasoning, the fact that a traditional store asks such a question is a big signal that maybe the norms have started. catch.

Most recently, the Iranian government announced it would freeze the bank accounts of women who refuse to wear the hijab, the traditional Muslim head covering, in public. This comes after threats of imprisonment and execution to quell ongoing protests for freedom of expression there. On December 8, 2022, one protester was executed by hanging by the Iranian government.

The truth is, no one will save you. Ethereum claims to be the internet’s new decentralized money, but its protocol imposes Office of Foreign Assets Control (OFAC) sanctions on its base layer. So it is quite clear that Bitcoin is the only money of freedom that is easy to transport. I think this difference will become more apparent as 2022 continues.

Altcoin Bonanza Goes Down in Flames

“The same technology that enables peer-to-peer money has enabled peer-to-peer fraud.”

-Lyn Alden, “Swan Signal” episode 92

From Celsius, to Three Arrows Capital, Luna, FTX, BlockFi, Voyager, and even Gemini, companies dealing with altcoins are all feeling the pain in one way or another – Leverage, rehypothecation, algorithmic Ponzi schemes and more. It seems that the biggest use case for crypto is making money quickly at the expense of others, when the carpet pulls the norm as your exit liquidity. It’s like the 1990s tech boom all over again.

One of the most interesting parts of this whole debacle is the alleged shortage of bitcoins held in FTX after its balance sheet was revealed in a bankruptcy filing. Whether the allegations are true or not, the fact that it is a legitimate question is illuminating. Looks like it’s on fire. I think, slowly but surely, people are starting to see the difference and realize that Bitcoin and crypto are not the same thing.

Turning Point 2023

Bitcoin has distinguished itself not only from the traditional banking system in a meaningful way, but also from crypto.

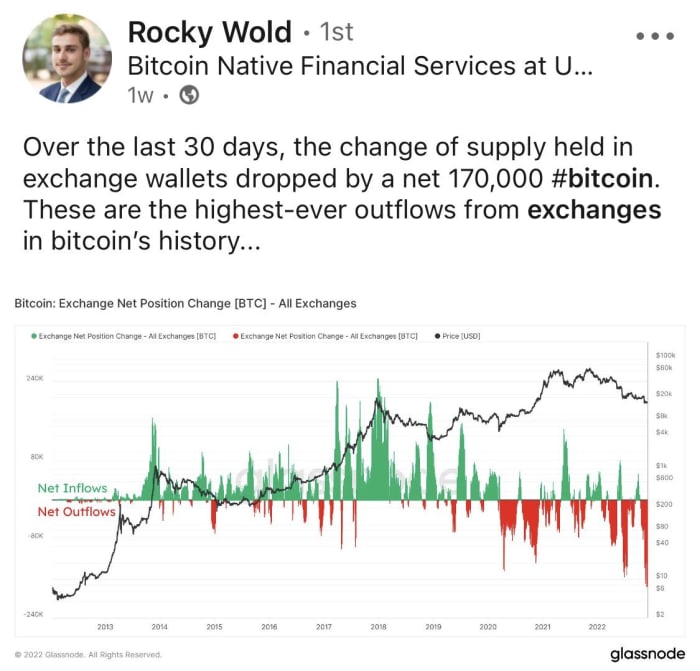

The FTX debacle has highlighted the need for self-custody: that your coins may not exist and the only way to find out if they actually are is to take custody. Bitcoin is now leaving exchanges in droves.

Could this be a turning point for Bitcoin? Can people wake up to the importance of mass self-preservation? Only time will tell. I am optimistic that this trend will continue, taking power from centralized exchanges and the ability to implement censorship on behalf of hostile regimes. As far as I’m concerned, the more bitcoins you have in your custody, the better.

If you’re still hesitant to take custody on your own, I recommend watching some BTC Session demonstrations. It really isn’t difficult and the peace of mind is priceless. I almost lost it all earlier this year when Celsius blew up. Don’t be like me. Stop procrastinating and get your bitcoins today. Only then will you understand why and how they differ.

This is a guest post by Mickey Koss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.