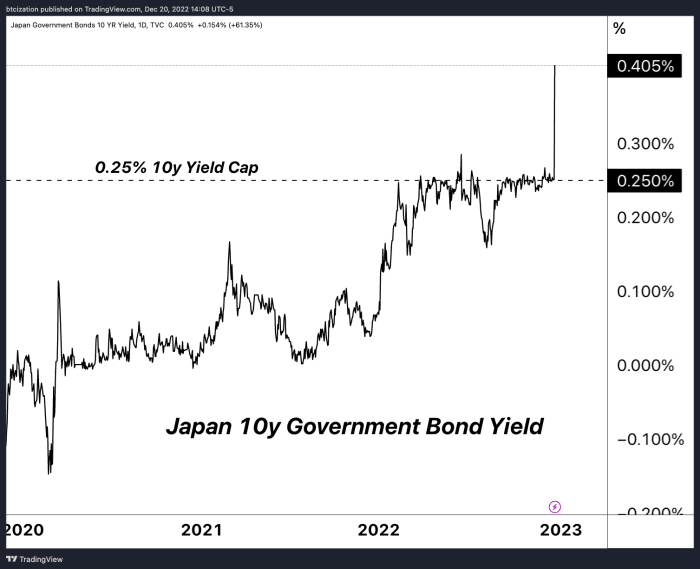

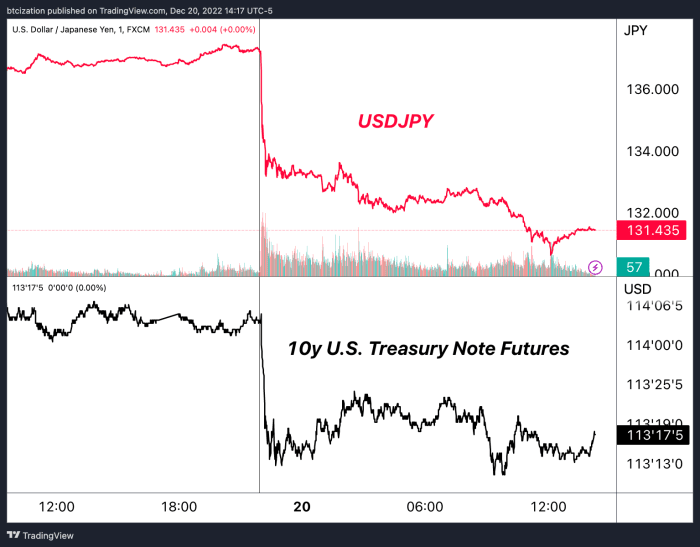

On the evening of December 19, the Bank of Japan (BOJ) announced that it had increased the cap on the 10-year bond yield from 0.25% to 0.5%, while keeping short-term and long-term interest rates unchanged.

The link to the tweet is attached.

The cap at the 0.25% rate has dampened the global bond market by using unlimited money printers for Japanese debt. This led to a significant drop in the yen against the dollar, while the BOJ used its stack of Treasurys to occasionally defend the currency against speculators.

The link to the tweet is attached.

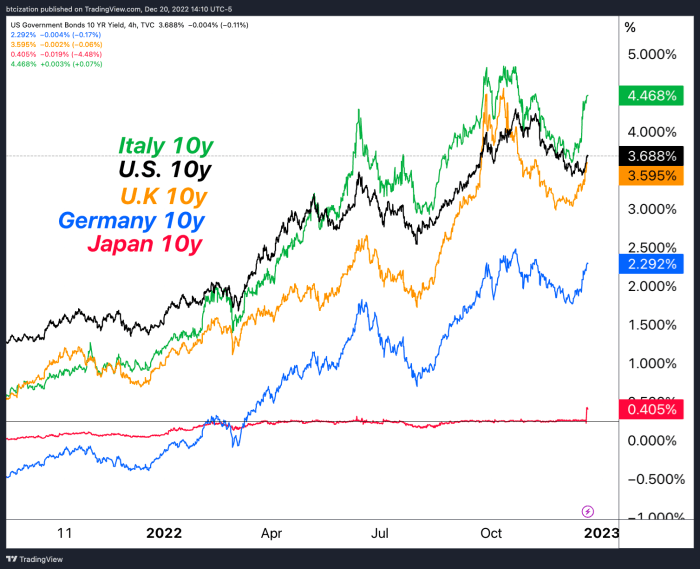

While it is a huge change to market dynamics, the move still leaves the BOJ far below its peers in terms of policy rates, which is mainly due to Japan’s demographics and debt-to-GDP statistics.

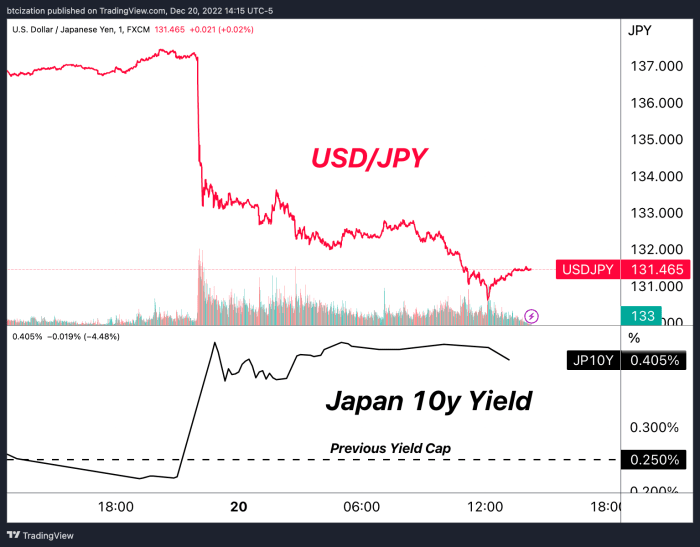

This yield-cap hike, which was unexpected by economists, caused an immediate jump in the yen and a slide in global government bonds, sending shock waves through global financial markets. It also led to a rise in Japanese bank stocks, as investors expected better earnings for financial institutions.

As the BOJ tightens policy, Japanese debt becomes more attractive and yen appreciates. This causes rates to tighten in the US market, but causes the dollar to weaken relative to the foreign exchange market.

As bond yields remain at higher levels than in recent years, asset valuations are based on discounted cash flows. While many market participants await the return of conditions like 2021 for various financial markets, understanding how changes in debt markets affect all other liquid markets and relative valuations is key.

Historical interest cost shocks occur at the same time as the largest absolute pullbacks in asset prices. We expect the riots to only take off from here.

While the bitcoin market has already massively deleveraging itself, “trading pain” (as many think it) can only be a full period of sideways consolidation because the legacy market dominoes begin to fall with increasing frequency.

We expect the next secular bull market to be driven by an accommodative monetary policy response to evolving conditions. now. Global financial market liquidity conditions, credit worthiness and asset price valuations are likely to decline from here – until the fiat monetary masters decide to start debasing. For better or worse, this is the name of the game in fiat monetary standards.

The link to the tweet is attached.

We are firm in step three. Stay strong girl.

Enjoy this content? Subscribe now to receive PRO articles directly in your inbox.